Navigating the Transformation of the Global Economic Landscape

Written on

Chapter 1: The Era of Low Interest Rates

The last decade and a half has been exceptionally favorable for investors, with the stock market showing robust growth. Since the 2008 financial crisis, the economic environment has undergone significant changes, necessitating a reevaluation of financial strategies.

Section 1.1: Historical Context of Economic Policies

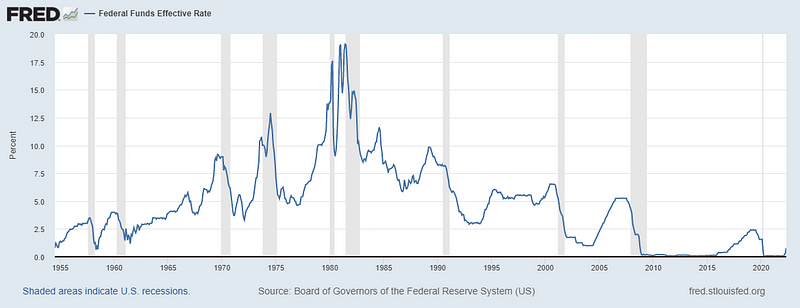

For an extended period, we enjoyed a climate characterized by extremely low interest rates, a favored monetary strategy among governments worldwide. The Federal Reserve's baseline interest rates illustrate this trend.

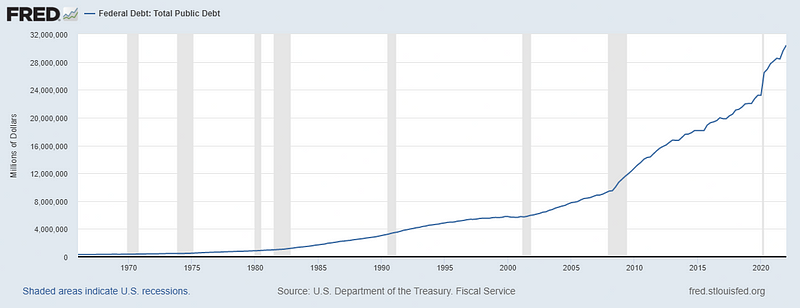

Since the housing market crash, rates have consistently remained below 2.5%, often hovering near 0%. This environment made borrowing more affordable, encouraging increased debt accumulation, particularly for the U.S. government.

Lower rates fueled economic growth and investment, propelling the Western economy forward, albeit with consequences to consider.

Section 1.2: Catalysts of Economic Change

Recent global events seem to be converging in a way that suggests a substantial economic shift. We are facing a pandemic, a major European conflict not seen in decades, and inflation rates reminiscent of the past 40 years—all occurring simultaneously.

The pandemic and subsequent lockdowns drastically reduced demand for goods, prompting the Federal Reserve to implement unprecedented quantitative easing measures. After 15 years of such policies and low interest rates, we now find ourselves at a critical juncture.

Chapter 2: The New Economic Reality

As we analyze the recent Consumer Price Index (CPI) data, the implications are alarming. In May alone, CPI surged by 1.0%, bringing the annual increase to 8.6%.

To combat ongoing inflation, the Federal Reserve is poised to raise interest rates, signaling a potential shift towards a prolonged period of elevated rates. This marks a departure from the previous low-interest landscape, which encouraged riskier investments as investors sought yields.

We Are Entering a New Economic World - This video discusses the generational shifts in the economic landscape, exploring the implications of recent global events.

The impact of rising rates will reverberate across all markets, particularly affecting stocks and bonds, the primary investment vehicles for large capital. As bonds regain popularity, stocks may see reduced interest.

Additionally, sectors like housing and oil will also feel the effects of this shift. The interconnectedness of our economy underscores the significant influence of the Federal Reserve.

Is a New World Economic Order Emerging? - This video analyzes the potential emergence of a new economic framework in light of recent challenges.

However, it’s also possible that these predictions could be misplaced. Should a recession occur in 2023, the Federal Reserve might revert to lowering interest rates to stimulate growth, deferring the consequences of debt further into the future.