Investing in High-Growth Stocks with Disruptive Innovation Potential

Written on

Understanding Growth Stocks

Growth investing has proven to be highly lucrative, exemplified by funds like Cathie Wood’s ARK Innovation ETF (ARKK), which has seen an impressive surge of over 200% in the past year. The remarkable performance of these growth funds can largely be attributed to disruptive companies that capitalize on unprecedented technological advancements. These firms have the capacity to transform their respective sectors by enhancing simplicity and accessibility while simultaneously reducing costs through innovative, tech-driven offerings.

With the current market pullback, long-term investors have a compelling opportunity to acquire shares of these disruptive growth stocks. In this article, we will delve into the defining traits of growth stocks and explore methods for pinpointing the leading companies that are reshaping their industries.

What Defines a Growth Stock?

Growth stocks are defined as companies that experience a faster increase in revenue and earnings compared to their industry peers. These entities achieve substantial growth by launching groundbreaking products or services that capture market share from competitors or by creating entirely new markets.

Investors reward these high-growth stocks with significant returns, correlating the speed of growth with potential gains. In contrast to value stocks, high-growth stocks tend to carry higher price-to-earnings (P/E) and price-to-sales (P/S) ratios. Despite their elevated valuations relative to current earnings, the most promising growth stocks can still yield substantial returns as they realize their growth potential.

Identifying Growth Stocks

With a plethora of stocks available, how can we discern the top growth stocks to invest in for 2021? Utilizing a screening tool allows us to sift through thousands of stocks and filter for those exhibiting robust revenue growth. By compiling a list of the fastest-growing companies, we can then conduct a fundamental backtest to identify the most promising growth stocks for our portfolio. Additionally, qualitative analysis can refine our selection.

Screening for Growth Stock Candidates

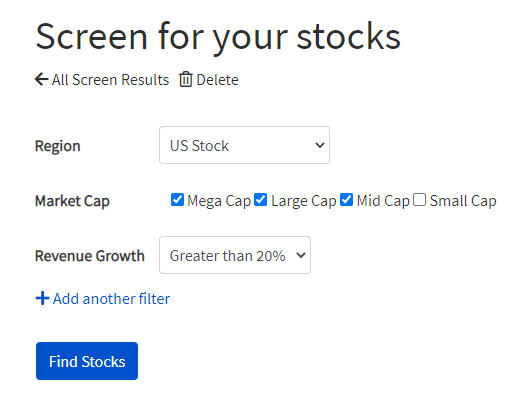

To initiate the screening process, we will focus on the following criteria:

- Stocks listed on U.S. exchanges

- Mid-cap companies and larger

- Revenue growth exceeding 20%

Select the U.S. Stock option in the Region field. Under Market Cap, check the boxes for mega cap, large cap, and mid cap. Add a filter for revenue growth and set it to greater than 20%. Finally, click the blue button to generate your list of potential stocks.

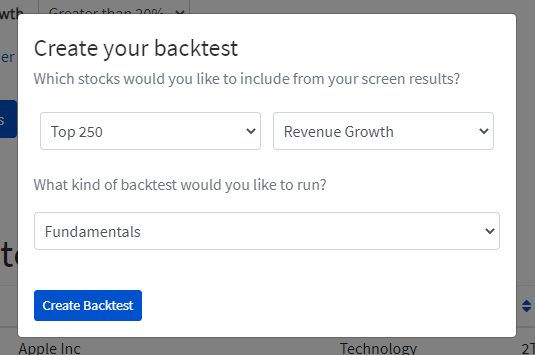

This process will yield a list of over 500 stocks meeting our criteria. Among these, stocks like Apple, which achieved a 21.4% revenue growth last year, will be highlighted. Click the button to create a backtest using these results.

Backtesting Our Growth Investment Strategy

Upon initiating a backtest, you will be directed to a page populated with the top 250 stocks identified through our screening process based on revenue growth.

Next, we will select three key metrics to assess our stocks: revenue growth, profit growth, and price-to-sales ratio. By focusing on growth indicators such as revenue and profit growth, we also consider valuation to avoid overpaying for stocks. The price-to-sales ratio is preferred here because many of these growth companies may not yet be profitable, making their P/E ratios undefined.

The selected signals are normalized and assigned equal weights of 33% to create a comprehensive ranking system for all 250 stocks, enabling us to identify the best growth stocks for our portfolio.

Constructing a Diversified Growth Portfolio

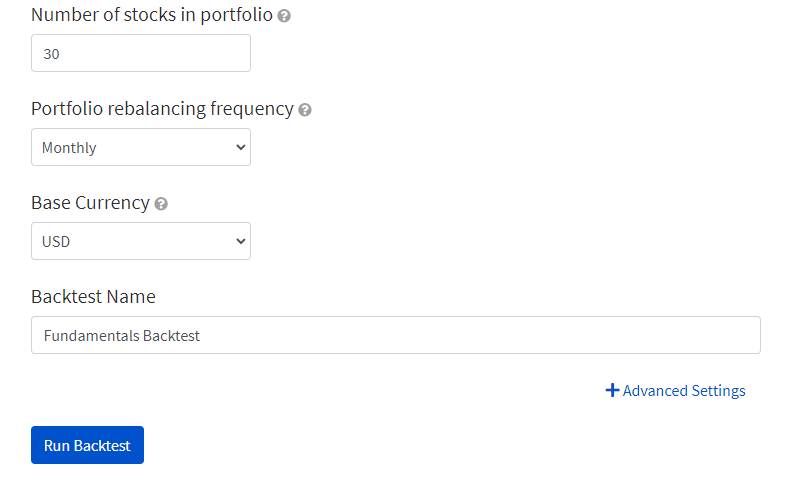

Choose the number of stocks to include in your portfolio. We recommend selecting 30 stocks, each weighted at 3.3% to minimize concentration risk. This strategy enables us to bet on the overall performance of growth stocks rather than relying on the success of a single company.

We will also set a monthly rebalance frequency to limit excessive trading and reduce transaction costs. Each month, the 250 stocks will be re-evaluated based on our selected metrics, and the top 30 stocks will form our portfolio.

After setting your parameters, click the run backtest button to execute your growth investing strategy.

Our strategy reveals an annualized return of 32%, volatility of 25%, and a maximum drawdown of 39%. When compared to ARKK, we observe a significant correlation in performance, attributed to shared exposure to growth stocks. While ARKK boasts a slightly higher annualized return of 34%, our strategy achieves a superior risk-adjusted return, as indicated by a higher Sharpe ratio (1.08 vs. 0.99).

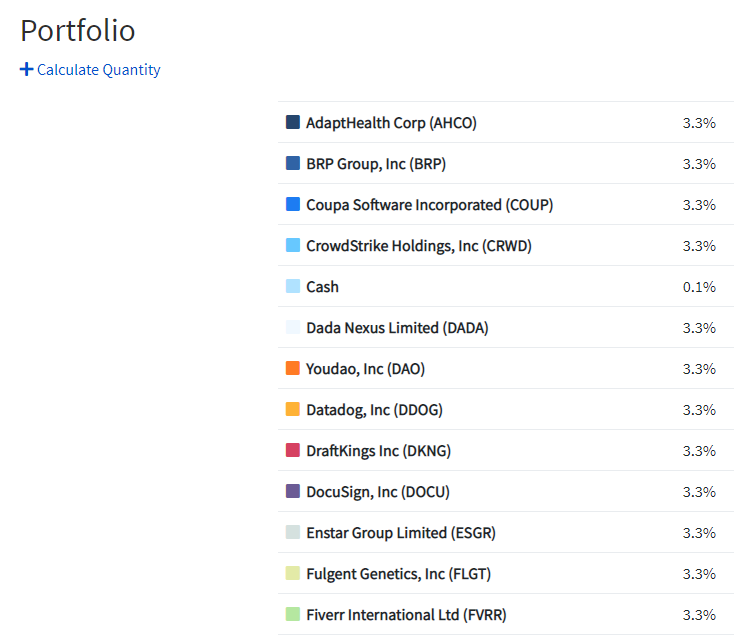

Exploring the Current Portfolio

As you scroll down, a list of the stocks currently included in the strategy's portfolio and their respective weights will be displayed. These are the leading growth stocks selected based on our chosen metrics.

For those who prefer a fully systematic approach without human bias, investing in all 30 stocks from your backtest portfolio is an option.

Fundamental Analysis for Growth Stocks

Qualitative investors may wish to conduct further fundamental analysis to refine their selection from the initial 30 stocks to a more manageable 15 to 20. One effective strategy is to identify companies poised to benefit from significant market trends. Firms that can leverage these trends often experience exponential profit growth, resulting in substantial returns for their investors.

For instance, one stock recommended by our model is Fiverr, an online platform for freelancers in creative sectors. With a projected growth of the gig economy to $100 billion in the U.S., Fiverr has witnessed its revenue growth accelerate to over 80% year on year.

Another approach involves looking for companies with robust economic moats that can sustain their competitive advantages and protect their market share from rivals. A prime example is CrowdStrike, a leader in cybersecurity with a groundbreaking approach to endpoint security. By employing artificial intelligence to learn from past cyber threats, CrowdStrike’s platform adapts to provide effective cybersecurity solutions, creating a formidable barrier against competitors.

Conclusion

Investing in growth stocks offers significant profit potential for long-term investors eager to engage with companies experiencing rapid growth through innovation. We have outlined how to build a portfolio of high-growth stocks utilizing screening tools and fundamental backtesting. Additionally, we discussed how qualitative analysis can enhance stock selection. We hope you can leverage these strategies to succeed in growth investing.

Happy investing, and may fortune favor you.