The Future of Bitcoin: Debunking Myths and Misconceptions

Written on

Chapter 1: Misunderstanding Bitcoin

If you were to offer Warren Buffett all the Bitcoin available for just $25, he would likely refuse. He has famously referred to it as “rat poison squared,” while Berkshire Hathaway’s Vice Chairman, Charlie Munger, has described trading cryptocurrencies as “just dementia.”

While it’s commendable that they hold firm to their beliefs, the reality is that they are mistaken. Their skepticism dates back to when Bitcoin was valued at less than a dollar, and it will persist as Bitcoin approaches $100,000 and beyond.

Here’s a deeper look into what the critics of Bitcoin, including Buffett, have to say.

Despite Buffett’s stance on Bitcoin as a non-generating asset, he acknowledged that the underlying blockchain technology is groundbreaking. This perspective echoes the sentiment of recognizing the potential of technology even when its applications are not fully understood. It’s akin to dismissing the internet while appreciating the value of email.

Buffett’s historical record shows a pattern of skepticism toward transformative technology: he criticized and missed out on Google, Amazon, and Apple, only to buy Apple at its peak. His stance on Bitcoin mirrors this trend.

The takeaway? Buffett, as a wealthy individual, is out of touch with the evolving tech landscape, including cryptocurrency, which embodies both technological and social transformation.

Section 1.1: The Greater Fool Theory Explained

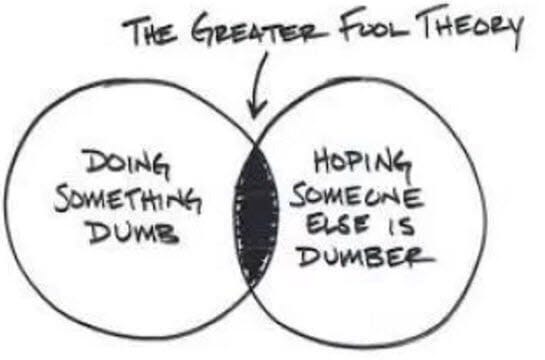

The notion that Bitcoin operates under the "Greater Fool Theory" suggests that individuals purchase it with the hope of selling it later at a higher price. This contrasts with traditional stocks, which represent shares in profitable companies.

However, one might also invest in Bitcoin as a way to safeguard wealth against destabilizing monetary policies, ensuring that one’s assets remain secure from external control.

Subsection 1.1.1: Bitcoin vs. Traditional Assets

Critics of Bitcoin often argue that its value relies on finding a “greater fool” willing to pay more. This description applies to all assets, where the price increases as long as buyers are present.

What sets Bitcoin apart is its limited supply, preventing inflation, unlike traditional stocks. As pointed out by Arthur Hayes, Bitcoin and Ethereum are pioneering a decentralized financial system that continues to withstand various challenges, including wars and economic downturns.

Section 1.2: Debunking Blockchain Criticisms

Blockchain technology is often dismissed as a waste of resources used by those seeking quick wealth. However, this criticism fails to consider the extensive inefficiencies of centralized financial systems.

The energy consumption required by traditional banking far exceeds that of securing the Bitcoin network. Moreover, innovations like Ethereum are on the brink of dramatically reducing their energy needs.

Chapter 2: The Future of Blockchain and Bitcoin

In the video “Bitcoin's Next Big Move: The Calm Before the Storm?”, experts discuss the current state of Bitcoin and what lies ahead, providing insights into its potential trajectory.

Another relevant video, “Bitcoin, the Death of Crypto is Happening Again - This is Next,” explores the cyclical nature of cryptocurrency markets and the future of Bitcoin.

As Robert Greifeld, former CEO of Nasdaq, stated, “Blockchain is the biggest opportunity set we can think of over the next decade.” A significant number of leading companies are embracing blockchain technology, while showing reluctance toward Bitcoin itself.

This desire for blockchain without Bitcoin reflects a preference for controlled systems, which raises questions about the future of Bitcoin. Nevertheless, institutional interest in Bitcoin is steadily increasing, with major players like Fidelity and MassMutual investing in the cryptocurrency.

In conclusion, while some may claim that Bitcoin is on the verge of extinction, the reality is that it is here to stay. By 2030, when Bitcoin potentially surpasses $1 million, will its critics finally acknowledge their misjudgments, or will they continue to regard it as merely a speculative bubble?

As always, it’s essential to conduct thorough research before making any investment decisions. This article was initially shared on my Substack. Join over 2,000 subscribers for a free copy of my new eBook, “Gold2.0.”